Part 1 of our post on coworking invoices dealt with setting up templates for your invoices, including all the information you legally need to, plus any information that is the same for all invoices. After finalizing your template, it’s time to focus on the details and make sure you don’t miss a thing.

There are two main things you should be extra careful about in your invoices. The first is typing errors; How easy is it to accidentally type 300 instead of 30? The second is outdated or missing information. Which membership plan does your coworker have? For how many hours has he or she used the meeting room this month? Does he or she really still have that extra key set? This can be especially tricky when billing new coworkers for the first time.

Descriptive service names

Make it easy for your customers to understand what they’re paying for. ‘Coworking Membership — Full-time Plan’ or ‘Drinks & Snacks’ are good examples of names for your services and products. ‘Green Unicorns Academy’ (for a software development workshop) or ‘Brew’ (for coffee) may go with your community’s tone and style, and are great for your marketing materials, but you do risk driving a couple of accountants crazy. And take it from us: you will want happy accountants :).

Important dates

These three dates should always be included in your invoices.

Service dates: Whether a monthly fee or a one-time charge, you should always refer to the date on which the service was provided. This small detail can save you emails back and forth finding out at what time and on which date meeting room bookings took place. The service dates are also particularly important for spaces that charge membership fees in advance and services at the end of the month, as this might otherwise cause some confusion concerning the basis for the total amount on the invoice.

Invoice date: When was the invoice created? This date will help you calculate how long it takes before you receive payment. For variable billing periods it usually denotes the cut-off date for one-off fees.

Due Date: Always include a crystal-clear due date in your invoices. If your invoice does not display the payment date, it can easily be interpreted as “pay when you can”. The use of expressions such as “30 net” or “next month” can lead to confusion. Be human. Speak in terms of days. For instance “Please pay your invoice within 30 days after the invoice date” or a simple “Due date: 31 March” have proved effective. From experience, we can recommend the first formula as the most effective — irresistible. If you use Cobot, you can include your payment terms in your invoice template footer to ensure they’re printed as part of every invoice you send out.

Correct figures

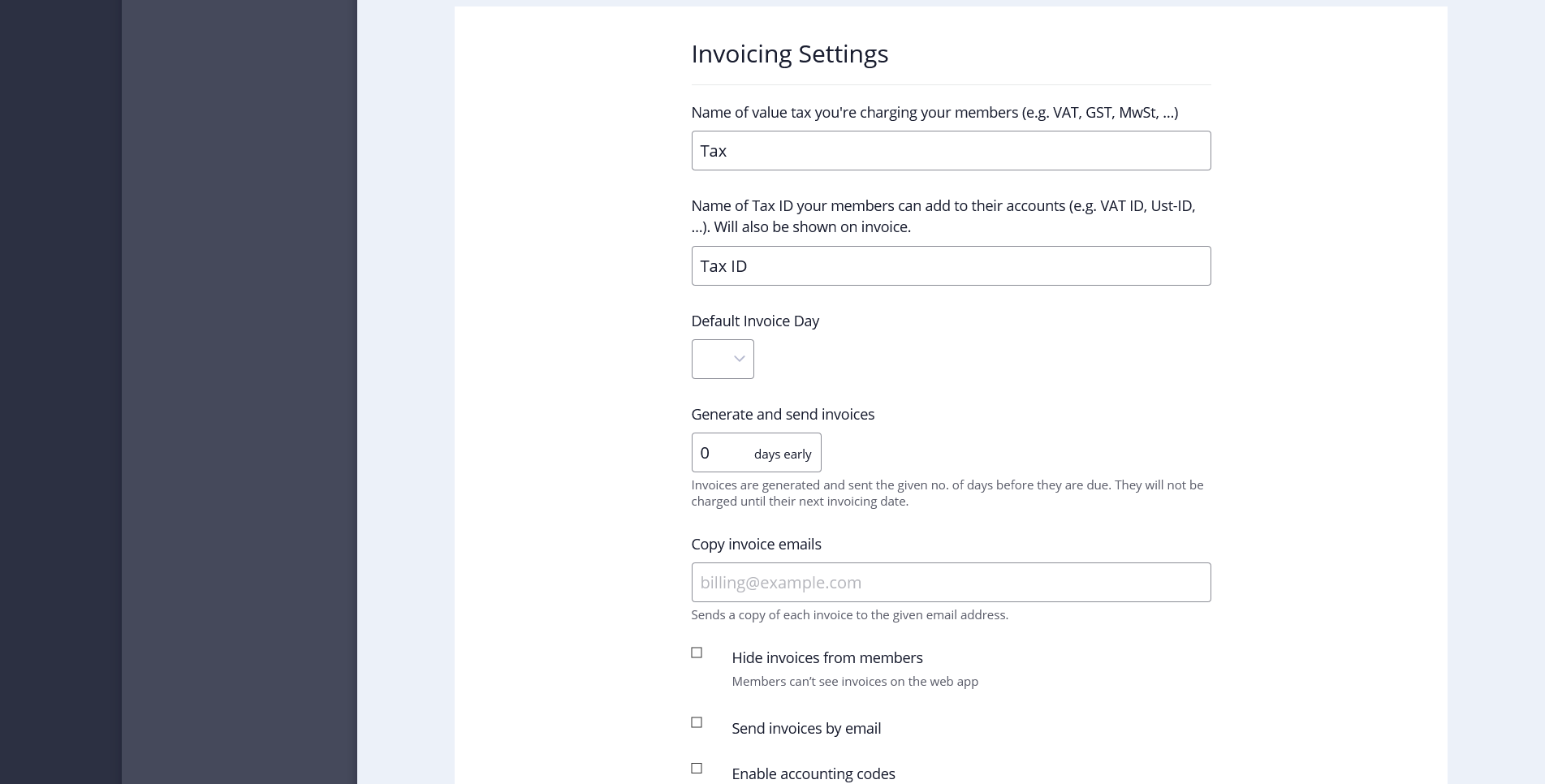

It may sound obvious, but you also need to ensure that the total invoice amount is the sum of all the items you have listed and check that the VAT calculation is correct. However, this is not so obvious when using a spreadsheet template or a text editor. Tools like Cobot can help you with this by keeping track of memberships and recurring fees, offering a point of sale to add one-off charges, tracking meeting room usage and bringing all of these fees together in the invoice. Automated billing is not error-free, but it does reduce errors and save time.

Of course, if you prefer manually writing every invoice, you can always continue to do so as long as you are aware that this makes you more likely to make mistakes. You are therefore advised to think of ways of reducing any errors, for instance by using checklists or running pre-invoicing checks.

Now it’s time to open your Cobot space, tune it up with this advice in mind, and start getting paid today!